Patient Financial Responsibility: The Growing Impact on Your Revenue Cycle

The Rise of High-Deductible Health Plans (HDHPs)

For example, the KFF reports that in 2025, the average deductible for single coverage reached $1,900, while the average deductible for family coverage was $4,500. This represents a substantial financial responsibility for patients and creates new challenges for practices:

-

Increased Patient Balances

A growing number of patients face high out-of-pocket costs, which can delay or reduce their ability to make payments. -

Administrative Burden

Staff must spend additional time communicating with patients, verifying benefits, and following up on unpaid balances. -

Cash Flow Pressure

Delayed patient payments directly affect the practice’s ability to operate efficiently.

Patient Transparency: Meeting Expectations in Modern Healthcare

Accurate Cost Estimation

Handling Billing Disputes

Effective Communication

Collections: Modern Challenges and Opportunities

Traditional post-service billing is no longer sufficient. The rise in patient responsibility requires a proactive approach to collections. Key strategies include:

Point-of-Service Collections

Collecting co-pays and partial payments at the time of service reduces the risk of outstanding balances. It also encourages patients to take responsibility for their financial obligations from the start.

Flexible Payment Plans

Offering monthly installment plans or financing options allows patients to manage their payments without undue stress, increasing the likelihood of full collection.

Automated Payment Reminders

Text messages, emails, and portal notifications remind patients of upcoming or overdue payments. Automation reduces administrative burden while improving payment compliance.

Proactive Patient Engagement

Staff training on effective communication about financial responsibility is essential. Practices that clearly discuss payment expectations up front experience fewer disputes and faster collections.

Studies indicate that practices implementing proactive collection strategies can reduce bad debt by up to 25%, significantly improving revenue cycle efficiency.

Impact on Your Revenue Cycle

The growing patient financial responsibility affects every stage of the revenue cycle:

-

Front-End Registration

Practices must verify insurance coverage and educate patients on potential costs. -

Eligibility and Benefits Verification

Accurate real-time data is critical to prevent billing errors and claim denials. -

Claim Submission and Denial Management

Increased patient responsibility may lead to partial payments or delayed claims, requiring efficient denial management and follow-up. -

Accounts Receivable

Practices face longer collection cycles, emphasizing the need for streamlined billing and consistent patient communication.

In short, revenue cycle management (RCM) must evolve to address these challenges and ensure sustainable cash flow.

Technology as a Solution: How MaxRemind Can Help

-

Automated Patient Billing

Generate accurate statements and send reminders automatically. -

Real-Time Financial Visibility

Track outstanding balances and payment trends to make informed decisions. -

Integrated Patient Engagement Tools

Enable clear communication, cost estimates, and flexible payment options. -

Denial Management Support

Identify issues quickly and reduce claim denials, improving collections.

By leveraging technology, practices can reduce administrative burden, optimize collections, and enhance patient experience – all while maintaining financial stability.

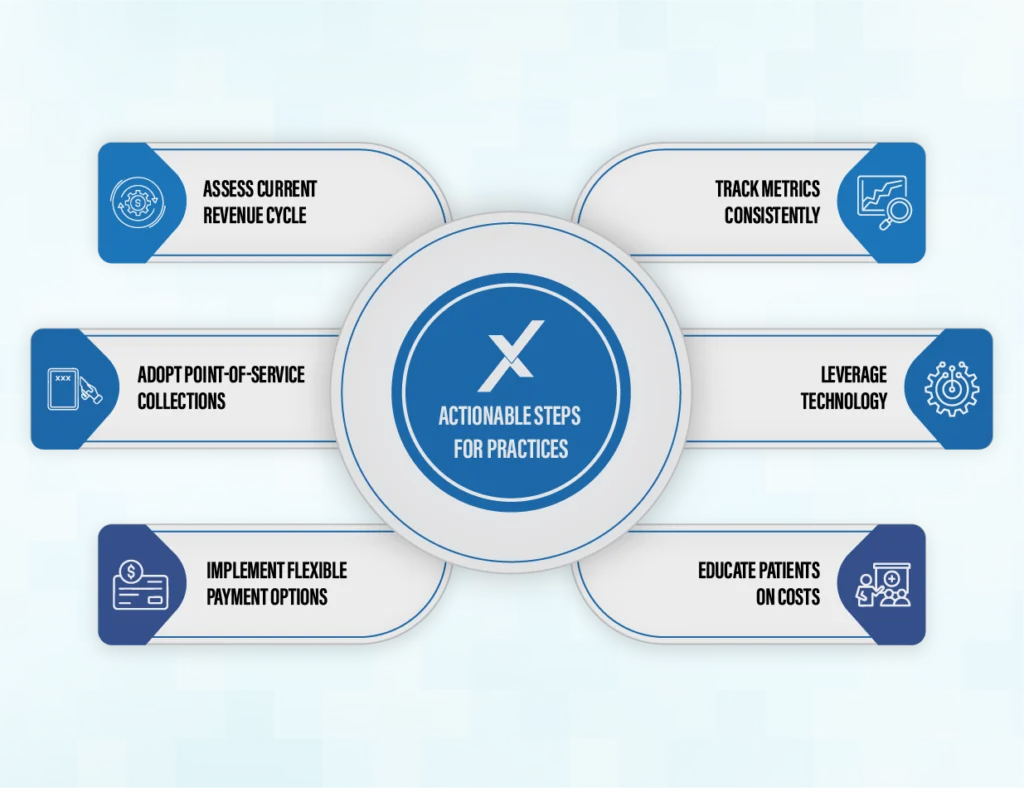

Actionable Steps for Practices

Here are concrete steps practice managers can take to adapt to growing patient financial responsibility:

-

Assess Current Revenue Cycle

Analyze outstanding balances, claim denial trends, and patient payment patterns to identify pain points. -

Adopt Point-of-Service Collections

Collect payments upfront when possible to reduce bad debt. -

Implement Flexible Payment Options

Offer installment plans or financing to make payments manageable for patients. -

Educate Patients on Costs

Provide clear information about HDHPs, copays, and deductibles through pre-visit communications and online resources. -

Leverage Technology

Use an integrated EHR and RCM platform like MaxRemind to automate billing, reminders, and reporting. -

Track Metrics Consistently

Monitor KPIs like days in accounts receivable, collection rates, and denial rates to optimize your revenue cycle continually.

These strategies not only help manage patient financial responsibility but also improve overall practice efficiency and patient satisfaction.

Conclusion

MaxRemind empowers practices with integrated EHR and revenue cycle management tools that streamline billing, enhance patient communication, and ensure a smoother, more predictable revenue cycle. By embracing these strategies, your practice can stay financially healthy while providing patients with the transparency and support they expect.

Better Billing for Patients. Better Cash Flow for You.

- What is patient financial responsibility, and why is it increasing?

-

Patient financial responsibility refers to the portion of healthcare costs that patients must pay out of pocket, including deductibles, copays, and coinsurance. It is increasing largely due to the rise of high-deductible health plans (HDHPs), which shift more costs to patients before insurance coverage begins. As a result, medical practices are now collecting a larger share of revenue directly from patients rather than payers.

- How does increased patient responsibility affect a practice’s revenue cycle?

-

Higher patient responsibility can slow down cash flow, increase accounts receivable days, and raise the risk of bad debt. Practices often face delayed payments, higher administrative workload, and more billing disputes. Without proactive collection strategies and accurate eligibility verification, these challenges can significantly impact overall revenue cycle efficiency.

- What are the most effective ways to improve patient collections?

-

The most effective strategies include collecting payments at the point of service, offering flexible payment plans, using automated reminders, and clearly communicating financial expectations upfront. Educating patients before visits and providing transparent cost estimates also improves trust and increases the likelihood of timely payments.

- How can technology help manage patient financial responsibility more effectively?

-

Technology streamlines billing, improves accuracy, and reduces manual effort. Solutions like MaxRemind’s integrated EHR and RCM platform automate patient billing, provide real-time visibility into balances, support denial management, and enhance patient communication. This allows practices to collect payments more efficiently while maintaining a positive patient experience.