5 Revenue Leakage Traps and How to Plug Them in Your Practice

Missed or Unbilled Services (Charge Capture Failures)

- Providers forget to document minor procedures

- Ancillary services (e.g., injections, diagnostic tests) are not captured

- Paper charge slips get lost

- Staff are overwhelmed and miss charge entries

- Implement real-time charge capture tools integrated with your EHR

- Standardize documentation procedures

- Conduct daily reconciliation between clinical notes and billing

- Use automation to reduce dependency on manual data collection

Using a modern RCM solution ensures that every service is captured, validated, and billed accurately.

Coding Errors & Missing Modifiers

- Wrong CPT/ICD-10 codes

- Missing modifiers

- Undercoding due to fear of audits

- Overcoding that triggers payer scrutiny

- Inconsistent provider documentation

- Ensure coders stay updated with AMA and CMS coding changes

- Conduct internal or third-party audits every quarter

- Use computer-assisted coding to reduce manual errors

- Provide provider training on documentation best practices

For accurate coding and improved compliance, practices often rely on MaxRemind’s certified medical coders, trained in specialty-specific guidelines.

Claim Denials & Poor Denial Management

Around 10 – 25% of medical claims are denied or rejected on the first submission – and many practices simply don’t have the bandwidth to follow up effectively. According to the Medical Group Management Association (MGMA), over 50% of denied claims are never reworked, resulting in massive preventable revenue loss.

- Eligibility errors

- Missing information

- Lack of prior authorization

- Incorrect coding

- Late submissions

- Track and categorize all denials

- Implement automated eligibility and benefits verification

- Build a systematic denial-appeal workflow

- Use analytics to identify recurring patterns

- Submit claims within 24 – 48 hours of service

Delayed or Incomplete Claim Submissions

- Missed deadlines

- Rejections

- Lost claims

- Administrative backlog

- Set strict internal timelines for claim submission (e.g., within 24 hours)

- Use automated claim scrubbing to reduce rework

- Digitize all documents and avoid paper workflows

- Track claims end-to-end in a centralized dashboard

Patient No-Shows & Ineffective Payment Collection

- Uncollected copays

- Missed appointments

- Weak follow-up for outstanding balances

- Lack of pre-visit financial transparency

Patient no-shows alone cost practices billions annually, according to the American Hospital Association.

- Implement automated appointment reminders

- Introduce no-show and cancellation policies

- Give patients upfront cost estimates

- Offer multiple payment options: card, online portal, SMS link

- Follow up consistently (soft reminders → firm reminders → collection workflow)

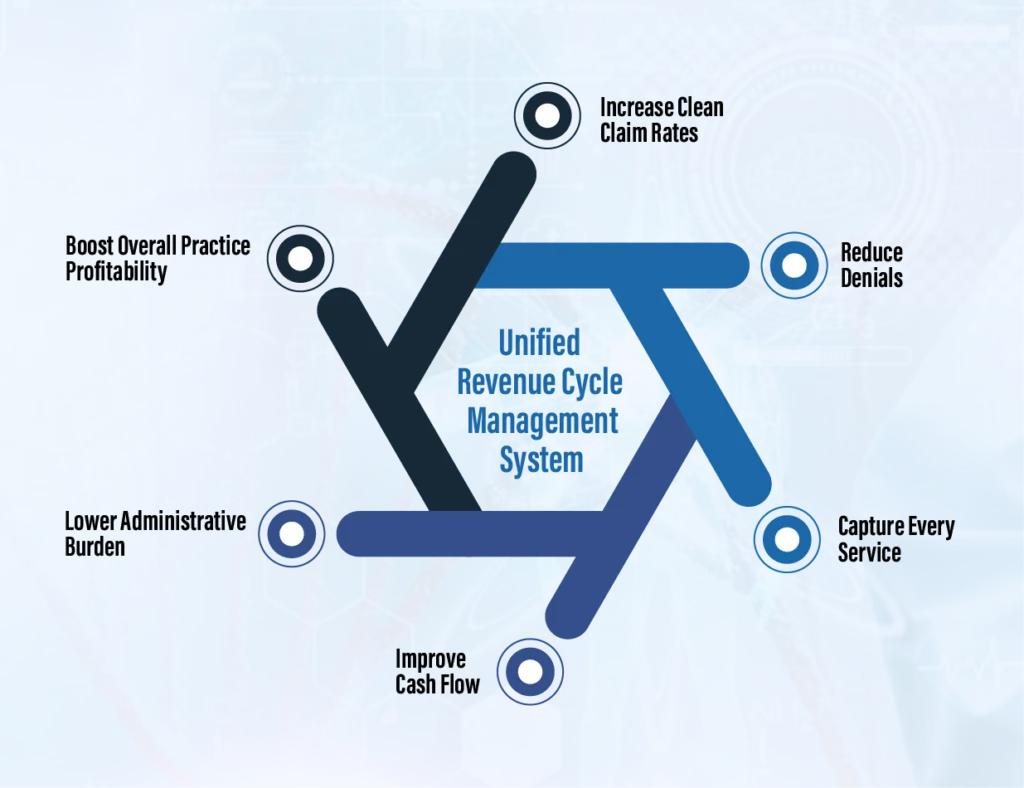

How to Plug These Revenue Leaks Once and for All

- Increase Clean Claim Rates

- Reduce Denials

- Capture Every Service

- Improve Cash Flow

- Lower Administrative Burden

- Boost Overall Practice Profitability

Why US Healthcare Practices Trust MaxRemind

- Automated charge capture

- Accurate medical coding & audit support

- Denial tracking & appeals management

- Eligibility verification

- Patient payment tools

- Specialty-specific RCM solutions

Revenue Leakage Is Preventable

Ready to Protect Your Revenue?

- What is revenue leakage in a medical practice?

-

Revenue leakage occurs when a healthcare practice loses money that should have been collected due to billing errors, missed charges, denied claims, or inefficient administrative processes. Over time, these gaps can significantly impact a practice’s profitability and financial stability.

- What are the most common causes of revenue leakage?

-

The most common causes of revenue leakage include missed or unbilled services, coding errors or missing modifiers, claim denials combined with poor denial management, delayed or incomplete claim submissions, and patient no-shows along with ineffective payment collection procedures.

- How can I prevent revenue leakage in my practice?

-

Preventing revenue leakage requires implementing a combination of strategies such as using automated charge capture and coding tools, regularly auditing billing and coding processes, systematically tracking and appealing denied claims, ensuring timely claim submissions, and adopting automated appointment reminders along with patient payment solutions.

- How much revenue can a practice lose due to revenue leakage?

-

The amount of revenue lost due to leakage varies depending on the size of the practice and the efficiency of its workflow. Even small errors in coding, missed charges, or uncollected patient payments can lead to thousands of dollars lost each month, which accumulates to a significant annual loss.

- How can MaxRemind help plug revenue leaks?

-

MaxRemind helps practices of all sizes by providing a comprehensive revenue cycle management solution. Their services include automated charge capture, accurate medical coding with audit support, denial tracking and appeal management, eligibility verification, and patient payment solutions. By combining AI-powered automation with certified specialists, MaxRemind ensures every claim is captured, billed, and collected efficiently, helping practices recover lost revenue and maintain long-term financial stability.